Global Sustainable Investment Review 2024

In November 2025, the Global Sustainable Investment Alliance (GSIA) published the seventh edition of the biennial Global Sustainable Investment Review (GSIR), finding that sustainable and responsible investment is moving from a niche practice to a systemic consideration.

In November 2025, the Global Sustainable Investment Alliance (GSIA) published the seventh edition of the biennial Global Sustainable Investment Review (GSIR), finding that sustainable and responsible investment is moving from a niche practice to a systemic consideration.

Click here to download the main report

Click here to download the data annex

Listen to a podcast with GSIA’s Chair discussing the report

Report Headlines

- Sustainable and responsible investment has moved from a ‘niche practice to a systemic consideration’, though the pace and scale of change remain insufficient to meet global challenges such as climate change.

- Positive developments including enhancements to sustainability disclosures, which began in the EU, have now spread across many GSIA regions.

- Despite challenging political and economic conditions over the last two years, there are signs that a ‘sustainable economic transition is underway’.

- But the report warns: without government interventions to transform the global economy, capital will remain incentivised to exacerbate – rather than limit and respond to – climate change.

Overview

The biennial Global Sustainable Investment Review, published during COP30 in Brazil, describes how the global economic, political, and sustainability landscape has been characterised by volatility and fragmentation over the last two years. However, throughout this period of uncertainty, a renewed effort is emerging to anchor finance within the transition to a net-zero economy, demonstrated by the steep rise in investment allocated to the clean energy sector along with data showing the green economy is the second fastest growing industry globally.

Fund-level sustainability disclosures, which began in the EU, have since been adopted across many GSIA regions. This has reset expectations for how we define and report sustainable and responsible investment, with an emphasis on moving the industry toward a more consistent and transparent standard of practice aligned to real-world change.

However, a weakening political consensus on climate policy has the capacity to undermine progress. In the absence of government interventions to reshape the global economy onto a sustainable trajectory, capital will remain incentivised to exacerbate climate change rather than address it.

Data Approach

For over a decade, the Global Sustainable Investment Review has tracked the growth in the use of responsible and sustainable investment approaches by bringing together comprehensive surveys from GSIA member organisations across major markets.

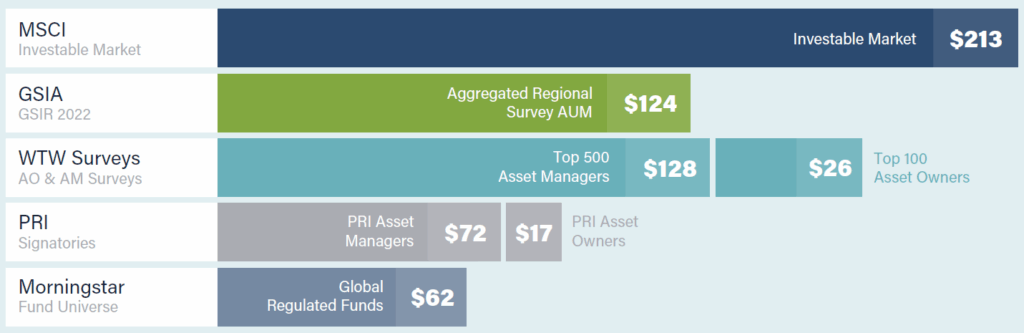

This year’s report was unable to draw on the traditional sources of data – large-scale surveys of fund managers across the world – which accounted for the vast majority of USD$124 trillion AuM covered in previous GSIR reports. To bridge this gap, we have included data from Morningstar, which limits the scope of analysis to legal fund public disclosures made by asset managers, significantly reducing the volume of assets covered (a greater than 50% reduction).

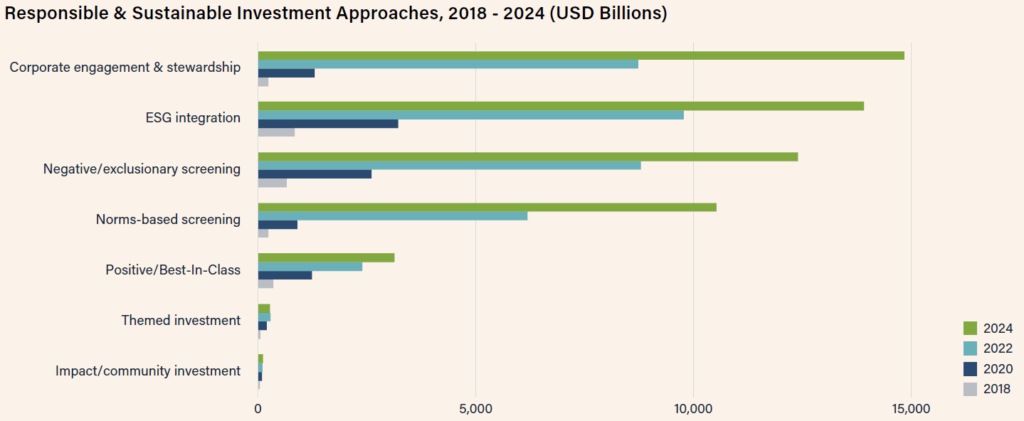

Despite these differences, there is a continuation of the trends highlighted in previous GSIR reports, including the rise of Stewardship & Engagement and increasing adoption of responsible and sustainable investment approaches, particularly in markets where regulations are more developed.

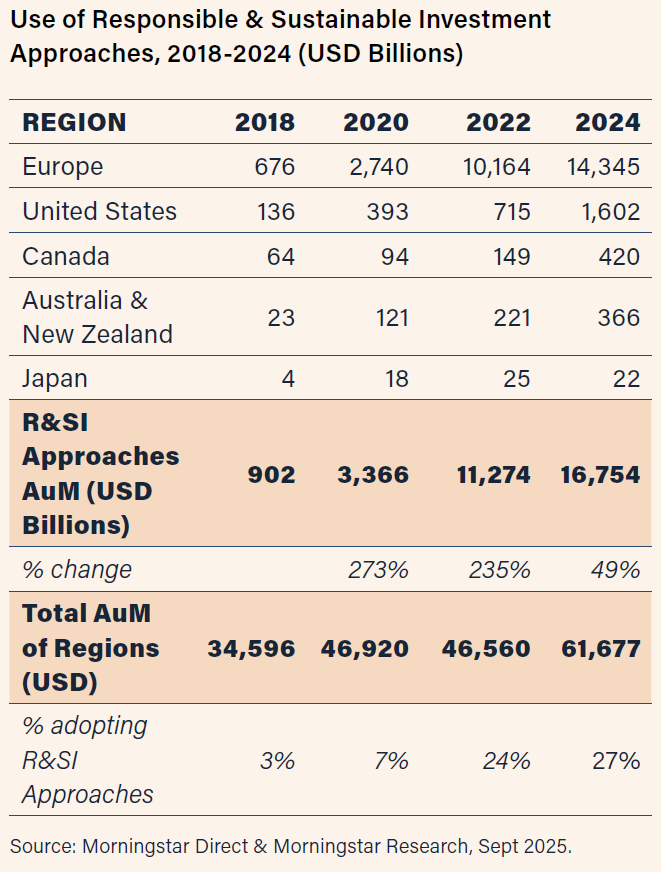

The analysis finds that the value of fund assets reporting the use of responsible or sustainable investment approaches has reached USD$16.7 trillion, increasing by nearly USD$5.5 trillion (49%) over the last two years, using the same Morningstar data approach.

Policy Recommendations

There exists in financial markets, a broad sense that the political and economic consensus around tackling climate change and building a global economy based around sustainability has fractured, reducing the investment rationale for the movement of capital towards sustainable projects and assets.

GSIA’s 2024 research on misaligned incentives identifies a fundamental “policymaker investment dilemma” whereby policymakers placed significant expectations on private capital to finance the transition without fully understanding the nature of investment decisions. Simultaneously, investors developed promises and commitments to achieve Net Zero by 2050, based on government policies that have failed to materialise at the pace required. The result is an impasse between policymakers and investors, driven by a fundamental misunderstanding of the conditions and assumptions underpinning investors’ Net Zero commitments.

Theoretically, investment decisions and capital flows are determined by the potential for financial return, given the associated risks and investment horizon. Practically, investors allocate capital into the projects, companies, sectors and regions that make up the global economy based on its current economic ‘shape’ and expectations of how this will change in the future. In the absence of government interventions to reshape the global economy onto a sustainable trajectory, capital will continue to exacerbate climate change rather than address it.

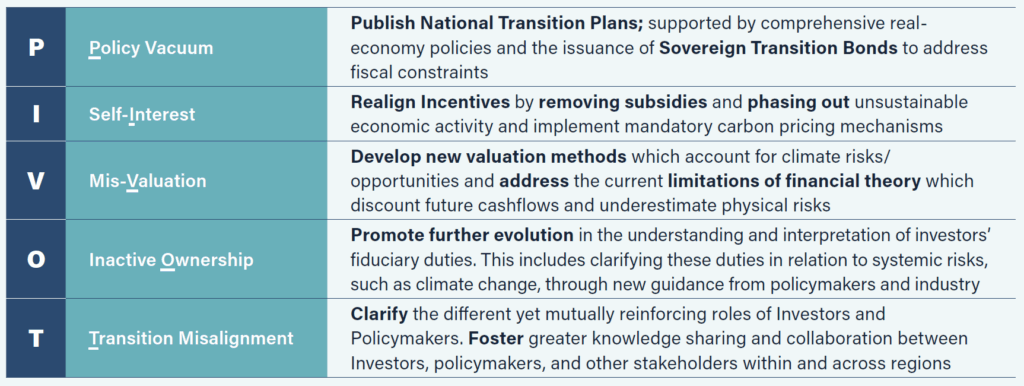

The “policymaker investment dilemma” and the structures that drive it continue to slow effective climate action by perpetuating behaviours and decision-making heuristics that are misaligned with climate goals. Our research has identified five barriers preventing the flow of capital to climate solutions and sets out actions to overcome the barriers and help direct investment towards projects and sectors that will accelerate the world’s transition to a sustainable future. Key actions are included in the table below, with more detail included in the full report.

Read the report launch Press Release.