Policy Positions

There exists in financial markets, a broad sense that the political and economic consensus around tackling climate change and building a global economy based around sustainability has fractured, reducing the investment rationale for the movement of capital towards sustainable projects and assets.

GSIA’s 2024 research on misaligned incentives identifies a fundamental “policymaker investment dilemma” whereby policymakers placed significant expectations on private capital to finance the transition without fully understanding the nature of investment decisions. Simultaneously, investors developed promises and commitments to achieve Net Zero by 2050, based on government policies that have failed to materialise at the pace required. The result is an impasse between policymakers and investors, driven by a fundamental misunderstanding of the conditions and assumptions underpinning investors’ Net Zero commitments.

Theoretically, investment decisions and capital flows are determined by the potential for financial return, given the associated risks and investment horizon. Practically, investors allocate capital into the projects, companies, sectors and regions that make up the global economy based on its current economic ‘shape’ and expectations of how this will change in the future. In the absence of government interventions to reshape the global economy onto a sustainable trajectory, capital will continue to exacerbate climate change rather than address it.

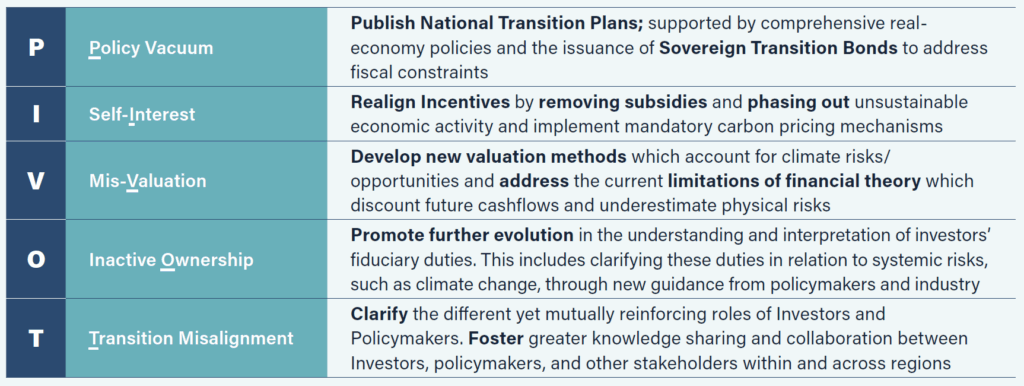

The “policymaker investment dilemma” and the structures that drive it continue to slow effective climate action by perpetuating behaviours and decision-making heuristics that are misaligned with climate goals. Our research has identified five barriers preventing the flow of capital to climate solutions and sets out actions to overcome the barriers and help direct investment towards projects and sectors that will accelerate the world’s transition to a sustainable future. Key actions are included in the table below, with more detail included in the full report.

To ensure progress matches the pace and scale demanded by global sustainability challenges, the international community must do more to support the finance industry to optimise the impact we can have. GSIA makes the following policy recommendations to the international community that, if implemented, would drive capital flows towards projects and investments that will accelerate the world’s transition to a sustainable future.

Net Zero Investment Opportunities

The GFANZ commitments made in 2021 at COP26 in Glasgow showcase the willingness of the world’s asset owners and managers to move vast private capital towards net zero over the coming decades. However, investors now require a large-scale pipeline of net zero investment opportunities to allow investment to take place.

National governments can unlock significant flows of capital from global investors, particularly those with strong commitments to GFANZ, if they put in place the right policy signals, supportive policy frameworks, and create investment opportunities. This will enable an acceleration of capital flows consistent with net zero commitments. Governments need to provide supportive capital market environments which align subsidies, market incentives, and government structures to ensure transformative public and private investment flows can be unlocked.

International Regulatory Alignment

Many asset managers and financiers have clients and investments across the world and report increasing challenges in aligning with the large number of regulatory approaches being developed. These regulatory approaches are often designed to achieve similar outcomes.

Governments, regulators, and standard-setters should work together to support closer global alignment on sustainable finance regulations to address fragmentation and support greater convergence, while avoiding a ‘lowest common denominator’ approach and being mindful of different regional environmental and economic circumstances.

We are broadly supportive of global efforts underway, including the ISSB, ESRS, IOSCO, NGFS and GFANZ, but more needs to be done. We recommend the international community – perhaps under the G20 Sustainable Finance Working Group – rapidly convenes a Sustainable Finance Regulatory Convergence Taskforce, to review the landscape and make recommendations for enhancements and greater alignment. As a global organisation, GSIA is well-placed to support and contribute to such a taskforce.

Enhance Data Availability

Efficient markets rely on transparent, accessible and comparable data – nowhere is this more true than in the rapidly-evolving world of sustainable finance. To ensure investors receive the data necessary to effectively incorporate sustainability factors into investment decisions, we are calling for the widespread and rapid adoption of a global baseline for strengthened corporate sustainability disclosures, ESG ratings and benchmarks. Such a baseline should aim to be as consistent as possible, while taking into account variations in circumstances across the world.

Nature And Biodiversity

The international finance community can play a key role in simultaneously helping to address climate change alongside biodiversity and nature loss, particularly through consideration of nature-related dependencies, impacts, risks and opportunities. We support moves by the international community to rapidly address these interconnected challenges.

We encourage governments to support and advance the disclosure frameworks that allow for better assessment of such risks and impacts, including the global adoption of the disclosure recommendations prepared by the Taskforce on Nature-related Financial Disclosures (TNFD) and the incorporation of TNFD reporting for corporations into the ISSB framework.